Payroll Giving is a way for staff to make a regular donation to Able Foundation through their pay, and change lives of people with learning disabilities. Donations are deducted from employees’ salaries before tax, making it an incredibly tax-efficient way of giving to Able Foundation.

Regular donations – like those from people who are signed up to Payroll Giving – are the best way to support Able Foundation. It means we have a reliable income we can count on, so we can plan long-term projects which help people with learning disabilities in all sphere of their life.

What’s in it for me?

Business benefits

- Allows your employees to donate to their chosen charity in a simple and tax effective way.

- Employees will see your business as more supportive and caring.

- Boosts staff morale and motivation – aiding retention and recruitment.

- Enhances your business’s charitable giving with little effort or cost to the employer.

- Enhances your social responsibility and community investment programmes.

- Allows you to monitor the level of charitable giving that your company has helped achieve.

- Any administration costs involved are tax deductible.

- It is really easy to set up a Payroll Giving scheme.

Staff benefits

- Payroll Giving is a tax-efficient and simple way to give.

- There is no limit on the size of the gift.

- It is easy and convenient, coming straight from the pay packet.

- There is no need to worry about Direct Debits or Standing Orders – just complete one simple authorisation form.

How do I get started? Employer

Payroll Giving Agency (PGA).

Payroll Giving must be administered through an HMRC-registered PGA. For contact details of registered PGAs see the end of this booklet. Your chosen PGA will advise you on the best way to set up.

If there are any questions that your chosen PGA can’t answer, have a look at:

www.hmrc.gov.uk/payrollgiving

What records do I need to keep?

- A copy of your contract with the Payroll Giving gency.

- The forms completed by your employees, authorising you to make deductions from their pay.

- A record of the deductions made from each employee’s pay.

- Receipts from the Payroll Giving Agency.

Promoting the scheme

- Show your real commitment to the scheme – think about matching your staff’s donations or at least covering the Payroll Giving Agency’s administration costs.

- Make sure employees know about the scheme – find someone to act as your Payroll Giving champion to promote the scheme and enthuse your staff about it.

- Have a promotional day – get your staff to talk about their favourite charities.

- Give all your staff a Payroll Giving form.

- Thank staff for signing up

- Include Payroll giving in your employee induction pack

Payroll giving agencies

Charities Trust

Suite 22, Century Building,

Brunswick Business Park,

Tower Street, Liverpool L3 4BJ

www.charitiestrust.org

Phone: 0151 284 5129

Fax: 0151 286 2360

Email: info@charitiestrust.org

Charitable Giving

Union Mine Road, Pitts Cleave,

Tavistock,Devon PL19 09W

www.charitablegiving.co.uk

Phone: 01822 611 181

Fax: 01822 618 718

Email: mail@charitablegiving.co.uk

Charities Aid Foundation

25 Kings Hill Avenue, Kings Hill,

West Malling, Kent ME19 4TA

www.giveasyouearn.org

Phone: 03000 123 000

Fax: 03000 123 001

Email: enquiries@cafonline.org

For other agencies see

www.hmrc.gov.uk/payrollgiving

Payroll giving is an easy and tax-effective way to support Able Foundation.

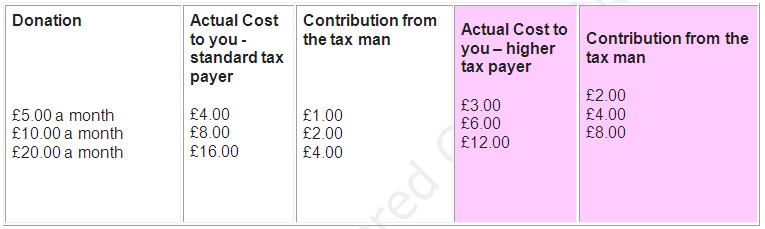

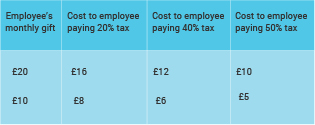

Payroll gifts are deducted via your payslip before tax and therefore the actual cost to you is just 80p for every £1 that we receive, or if you are a higher rate tax payer, just 60p.